The World has Gone Insane…You’re Still Sane so You Might as Well Take Advantage of It!

Are You Profiting from the Great Economic Reset?

The Largest Wealth Transfer in History…

You Can’t Do Anything to Stop It…

But You Can Ride the Wave to Huge Profits

I’m going to show you the kind of rewards that come from seeing the writing on the wall. This is has been incredibly lucrative for me…and it can be for you too.

We’re going through a Global Economic Shift, part and parcel of The Great Reset and the Fourth Industrial Revolution.

The magnitude of this has not been seen since World War 2…and what is happening NOW likely dwarfs that in size.

But before I dive into those details, I want to show you the possibilities. By seeing what is happening clearly you can position yourself to gain from it.

You might as well…because wishing it wasn’t happening isn’t going to help anyone.

Sticking your head in the sand doesn’t make it go away.

Getting distracted by the 10,000 other things going on, just means you’re missing the most important aspect of it all, the economics driving everything.

Welcome to Bitcoin and the Irrational Crypto Market of 2020-2022!

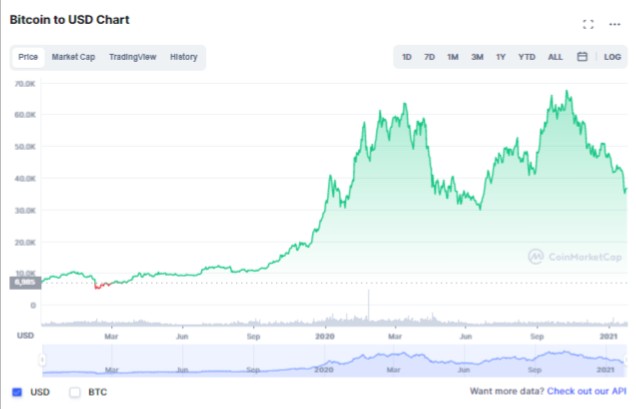

The best time to get in Bitcoin was when it started...or 2014...or 2015...or 2016...or 2017...or 2018...or March of 2020 after the pandemic hit, anytime up til the end of the year.

Or the May correction of 2021.

Did you miss all those opportunities? Here's the good news. The best time to get in is now with the recent downturn going on right now in 2022.

And if you think Bitcoin is crazy, you haven't seen anything yet!

You Only Need ONE Trade Like this to Make a DRAMATIC Impact...

Here was one of my best trades so far. No, I didn't sell it all at the peak. But I did take profits along the way.

With this token I turned an initial $1490 investment into $1916, $2795 and $5155 in profits while, despite the correction, I'm still comfortably sitting at over $10,000 in value.

Yep, I still have a portion of this token sitting at a big gain even if I sold now. But it is consolidating before it goes even higher once again. (In other words, I think NOW could still be a good time to get in…)

That was just a “small bet.” I certainly didn’t have all my money riding on it. (In hindsight, of course I wish I had put more in and/or sold off even more at the peak!)

Again, that's my best trade so far. But my overall crypto portfolio isn’t doing too bad...

My Crypto Portfolio was up over 300%...Even After the Recent Correction

NOW is the time to get it. So that even if there is another crash on the horizon, that will only be after you've made tons of profits.

Sadly, I made a bunch of stupid mistakes in 2020 and 2021 that handicapped my gains from being even better…ones that I want you to avoid!

And here’s the best news for you. These kind of gains aren’t over. In fact, they are just getting started.

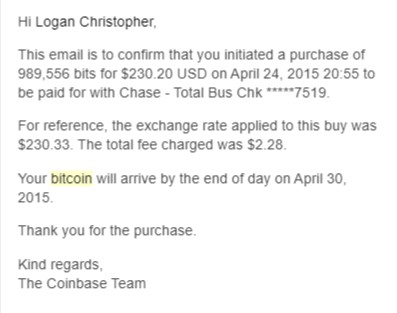

I first invested in Bitcoin in 2015 when it cost about $230 for a Bitcoin. (It’s up over 100X from that today!)

While Bitcoin is a worthy investment, it isn't going to be posting 10X or larger gains anytime soon. It likely will get back to new highs even this year, but probably not much beyond $100,000.

But there are plenty of others that are ready for 10Xing and more. That's why my current portfolio includes about 40 different tokens besides Bitcoin.

These kind of gains are going to continue for the foreseeable future and here is why…

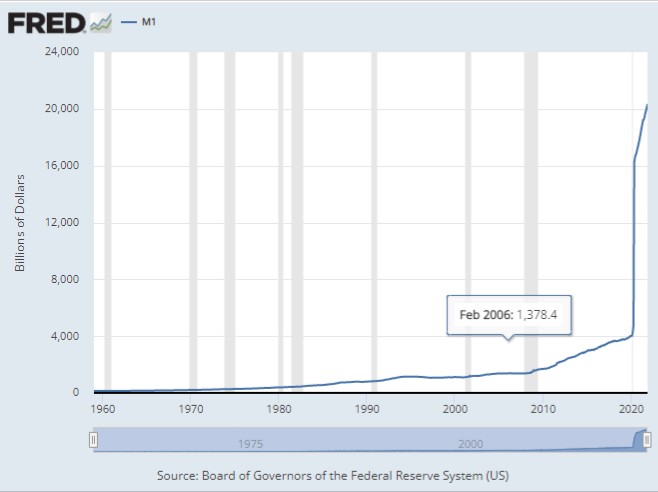

80% of the US Dollars in Existence came into being since 2020

And this pace is not slowing down!

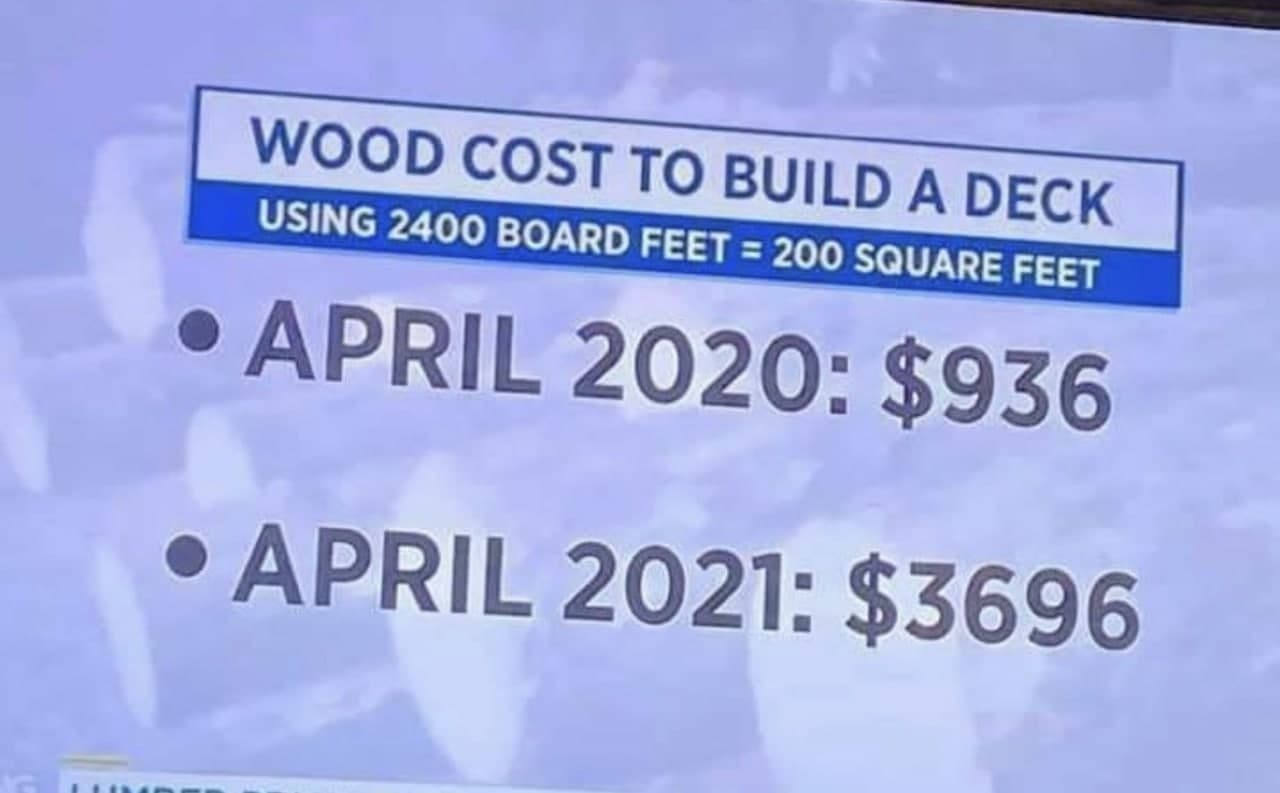

This money printing (as well as a handful of other factors) leads to this level of asset inflation going on. In other words, cryptocurrencies aren't the only place seeing these kind of gains.

Here are lumber futures up over 4X since the start of 2020 and that being reflected at your local Home Depot if you want to get these supplies.

House prices are rising fast. Most buyers are coming in all cash above asking prices (sometimes 20%+ higher!)

And gas prices, foods and virtually all other goods will come to reflect this. They're just starting to. Yes, there are other reasons at play behind all these different pieces...but behind them all is the massive money printing.

Be ready for more sticker shock to come.

This “hidden tax” means that every dollar you’ve earned and saved is rapidly losing in value.

Simply holding cash in a bank account means you are LOSING value daily.

These Are Unprecedented Times...

Yes, there is hype.

Yes, this is a bubble that will pop at some point.

Nothing goes up in price forever without correction, as the last few months saw.

BUT…there are a few key things that set 2021-2 apart from the past (including 2008 which led to the creation of Bitcoin in the first place).

Today's money printing is on a whole other level and shows no signs of going away…in fact, it’ll probably accelerate. This alone would drive up crypto prices, but it is not the only factor.

Add to this the ever-increasing adoption of crypto...

The Adoption of Crypto into the Mainstream is Happening Now and Will Ramp Up FAST…

With many people, even institutions seeing these trends, most dips are short lived when the buying pressure rushes in to get a deal.

This is a reinforcing loop. As more people get in, more people will get in. Both your average person on the street and big businesses too. We’re literally just getting started.

You’ve seen the headlines...

Big companies are seeking to adopt crypto as legitimate payment systems. Paypal posted record profits. Why? A boost in ecommerce sales as well as crypto. They’ve just invested in buying a digital assets security company named Curv.

Hedge funds are jumping in. The big banks and credit card companies and making it a viable commercial solution.

Soon you'll be able to spend crypto at any merchant, Visa is just handling it on the backend.

Even countries are getting in on the crypto game, El Salvador adopting it as legal tender.

IBM is doing patents as NFTs, non-fungible tokens, a specific type of crypto. If you don't know what that means, well you're missing the bigger picture.

Companies are storing cash in crypto instead of US dollars. And in Tesla's case this turns out to be more profitable than their operations! SpaceX owns Bitcoin too.

(Do you own a business with cash reserves? You can get in on this too, just like I've had my business Lost Empire Herbs do...)

Just Four Years to Riches…

Here are a couple of stats that may make your eyes bulge as you recognize the opportunity before you.

If you bought and held Bitcoin for a period of 4 years at ANY point of time in its short history, you would ALWAYS be profitable.

- The Average Return was 48000%

- The Best Return was 1100000%

- The Worst Return was 424%

Past performance is no guarantee of future performance. However, the chances of this continuing are extremely likely though the rates will go down (for Bitcoin).

Yes, I bought Bitcoin back in 2015...but sadly have not been holding onto it all that time.

Fortunately, now I have a multi-pronged strategy in place that won't cause me to make the same kind of mistakes again with Bitcoin and with other tokens.

It is not too late...but that time will come in the future. Yes, you should have got in years ago, but NOW is still available.

It's almost guaranteed. People will be saying I wish I had gotten in back in 2022.

If You Have Dabbled that’s Great…but You’re Still Not There…

A good friend of mine bought Bitcoin and Ethereum on Robinhood. Now he has to foot a huge tax bill on his gains because you absolutely do not want to use Robinhood for this (nor Paypal).

Not only that, he's missing out on much more opportunity because he's only dabbling despite having some major funds available.

I was dabbling up to 2020. It was the start of 2021 when I went pro. After I let the distractions fall away, I decided to go almost ALL IN. The majority of my assets are in the crypto space.

I know what you’re thinking. “That’s so risky!”

Yet this is inaccurate for the reasons already discussed.

Of course, the space comes with risk. There is no denying it is super volatile.

But because of the gains I’ve had I can survive about another 80% drop in all crypto assets and still come out ahead right now.

Even if that happened…there are some other assets I possess that would offset such a drop, likely to make me come out ahead once again.

The facts of the matter are that simply keeping money in US dollars is risky right now. They are losing money by the day as inflation goes on.

This is great for me, you may say. But there is still time. By starting now you can position yourself for the same. I want to show you how.

Introducing the Crypto Crash Course to Cut Your Learning Curve by 80%

This is designed to deliver four things to you:

1) Fast Track Successes (obviously)

2) Limit Mistakes (very important in this area…I’ve made many and will help you avoid the ones I’ve made)

3) Make Action-Taking Easy (Walk you through getting signed up on various necessary services, making trades, etc.)

4) Deliver a Multifaceted Strategy (perhaps the most important of all so that you’re not simply gambling or relying on the buy-and-hope strategy)

Obviously, I’m not a financial advisor, nor tax planner, just sharing what I know.

I offered this in a one-on-one coaching options that clients paid up to $2,000 to join. You can read their comments below.

But I put together this brand new course to deliver the same training on demand...

New! The Online Crypto Crash Course Delivered in Video On Demand

After coaching ten clients I took what I was covering and recorded it piece by piece on video, which is now available in a member's portal.

This is divided into three tracks, beginner, intermediate and advanced to get you up and running super quick and then moving onto the next stage when you're ready.

The Beginner Track to Get You Up and Running and Owning Crypto As Quickly As Possible

- Which Centralized Exchanges to Use and Which to Avoid

- Several Reasons Why it's Important to Use More than One Exchange

- Why You Should Avoid these Custodial Accounts and the Huge Tax Consequence a Friend Faces Because of Making this Mistake

- What are "Company Coins" and Should You Get Them?

- How to Minimize Your Fees for Trading

- Understanding how the Crypto Market Moves

- How to Buy and Sell, including Market and Limit Orders

- How to Onboard Your Fiat (like US Dollars)

- 3 Easy Investing Strategies, including One that Beats Most Day Traders

- The Two Tokens Worth Investing In for Simplified Portfolios (Yes, Bitcoin is one of Them)

- 3 Ideas for How Much Money to Put into Crypto

- How Bitcoin Mining, Blockchains and More Works - Simplified Explanations So You Know What You're Investing In

The Intermediate Track Helps You Move Beyond Centralized Exchanges, Earning Interest from Staking and "New Banks", the Security of Wallets, and Tax Strategy

- What is Intermittant Trading and Why Should You Do It

- There's a Way of Using Dollar Cost Averaging that Most People Aren't Aware Of

- Why Buy and Hold is Not Necessarily the Best Strategy Even if You're Long-Term Bullish

- How a Meta-Strategy is Especially Useful when it Comes to Crypto

- What are Crypto Wallets and How do You Use Them?

- Which Wallet Types are Safest and Best?

- How to Send and Receive Crypto, plus the Two Precautions to Take

- How Proof-of-Stake Works, and Why You Benefit

- Where to Stake What

- What are the New Crypto Banks and How This Will Cause Actual Adoption

- My Favorite Crypto Bank and Why

- How to Spend Crypto without Ever Spending Crypto

- How to Earn on Non-Stakable Cryptos

- Taxes! The Five Transaction Types that Must Be Reported

- A Free(ish) Software for Tracking Your Portfolio and Doing Taxes

- Two Crypto Tax Laws You Must Understand

- Important! How You Categorize Crypto Sales can literally turn $100,000 in Taxes into $1,000

- About Utility Coins and Network Effects

- What are Stablecoins and Why They Are Important?

- The One Stablecoin to Absolutely Avoid

- Which Stablecoins are Best and What's the Best Stablecoin Strategy

- A Quick Cash Bank Account that Actually Pays You Decent Interest (4%)

- And More

The Advanced Track Gets You Up and Running in the Fast-Moving (and Profitable) World of DeFi, plus Covers All Important Exit Strategies

- The Ultimate in Security for Your Crypto

- What is DeFi and Why It's Revolutionizing Finance?

- What are Gas Fees, and How to Save On Them

- dApps and How to Use Them

- Decentralized Exchanges and the Benefits of Using Them

- Which dApps are Best and Most Useful?

- Liquidity Pools and How to Earn Fees

- The Threat of Impermanent Loss You Must Be Aware Of

- What is Yield Farming and How People Are Replacing Their Incomes with it?!?

- Crypto Ecosystems and Moving Cross-Chains

- Diversification Goes Beyond Buying Different Tokens. Here's What is Even More Important

- How to Arbitrage

- The Small Bets Strategy (Key to 10X and Beyond Profit Gains)

- How to Profit from Flash Crashes

- Got a Business? Here's How to Stash Assets in Crypto for Your Company

- A Mistake Beginner's Make and How to Spread the Uncertainty Instead

- What is Your Exit Strategy? Here's My Five Pronged Exit

- Going "Degen" for Triple Digit Yields

- And Much More

This Crypto Crash Course is valued at $999. Anyone with a bit of money to invest can easily recoup that cost with the knowledge they're armed with inside.

After all, you could get that back just earning interest on stablecoins, without the volatility of the rest of the crypto market in a year.

But right now I'm not even going to charge that much for this hard-won knowledge...

Crypto Crash Course Online Program

Regularly $999

Only $399 Today